Imagine opening offices in new countries without the hassle of legal registration, setting up bank accounts, or managing local HR teams. That’s exactly what an Employer of Record (EOR) offers.

Essentially, an EOR acts as the official employer in a foreign market, handling payroll, tax filings, benefits, and ensuring legal compliance. At the same time, your company retains control of day‑to‑day management.

Using an EOR is particularly useful when exploring emerging markets, places like India, Brazil, or Southeast Asia, where navigating labor laws and administrative requirements can feel overwhelming. Instead of waiting months or investing in entity setup, you can begin operations and onboard employees in a matter of days or weeks.

The advantages go beyond speed. By partnering with a provider rooted in local regulations, companies significantly reduce compliance risk and avoid potential fines or legal missteps, especially critical in markets with evolving labor rules.

Furthermore, because many EORs operate on a fixed per‑employee fee structure, you gain clarity over costs without the upfront investment in legal entities.

This article walks through why leveraging an EOR in emerging markets can be a strategic advantage, covering benefits like fast market entry, legal protection, flexible talent access, and leaner operations.

Key Takeaways

- EORs enable fast market entry by handling payroll, compliance, and legal requirements without setting up a local entity.

- Using an EOR reduces upfront costs and offers predictable per-employee pricing, avoiding large entity formation expenses.

- Compliance risks are minimized since EORs manage local labor laws, taxes, and statutory obligations.

- Global talent access becomes easier, letting companies hire in emerging markets like India, Brazil, and Southeast Asia without geographic restrictions.

- EOR partnerships simplify HR operations, freeing internal teams to focus on strategy and core business growth.

- However, hidden fees and PE risks require careful evaluation when selecting an EOR provider.

Fast Market Entry And Scalable Hiring

Partnering with an Employer of Record (EOR) lets you launch operations abroad rapidly, sometimes within days, because they already have legally compliant entities in place.

Equally important, EORs make it simple to scale your workforce up or down in response to changing business needs, all while ensuring compliance with local laws.

1. Launch Operations In Days, Not Months

EOR providers already maintain fully registered legal entities in target locations. That means you bypass complex registration, tax ID issuance, and banking setup.

Once a candidate is hired, the EOR handles contracts, payroll initiation, benefit enrollment, and statutory obligations, all within a few business days.

No need to wait through licensing delays or entity formation processes, which can drag on for months. This speed lets you activate teams almost immediately.

Why it matters: Hire quickly before the opportunity passes.

2. Flexible Scaling To Match Business Needs

With an EOR, increasing or reducing staff in a given country is straightforward. Whether adding project-based roles during peak demand or downsizing after a cycle, the EOR executes hiring and offboarding while ensuring legal compliance.

There’s no need to navigate local termination legislation or wait for entity-level approvals. This flexibility supports adaptive workforce sizing without risk.

Why it matters: Match workforce size to business demand efficiently.

Cost-Effectiveness vs. Establishing Entities

Setting up a local legal entity in a foreign country typically involves significant upfront costs, such as registration fees, legal support, and administrative setup, which can run into tens of thousands of dollars.

By contrast, partnering with an Employer of Record (EOR) lets you bypass these expenses and benefit from a predictable monthly fee per employee, often resulting in cost savings of up to 30–60%.

Avoid Large Upfront And Ongoing Expenses

Establishing a local entity often involves significant upfront costs, including legal registration, accounting setup, office lease, and hiring HR personnel, which can range from $4,000 to $20,000 or more, depending on the jurisdiction.

In contrast, EOR services typically charge a flat monthly fee per employee (often 10–20% of salary), eliminating entity formation costs entirely. That translates into up to 30–50% savings on expansion costs, ideal for lean budgeting.

Why it matters: Predictable expenses, minimal financial risk.

Centralised Payroll And HR Infrastructure

With an EOR, payroll, benefits, tax filings, and HR compliance become part of a unified global platform. There’s no need to license separate software or hire in-country payroll teams for each jurisdiction, reducing redundant overhead.

Data consistency, automation, and built-in compliance, across currencies and regions, streamline operations while mitigating errors.

Why it matters: Operational efficiency, audit-ready accuracy.

EOR vs. Entity Setup: Comparative Table

| Feature | Employer of Record (EOR) | Local Entity Setup |

|---|---|---|

| Setup Time | 1–4 weeks | 2–6 months |

| Upfront Cost | Minimal | $4,000–$20,000+ |

| Ongoing Cost | Flat per-employee fee (~10–20% of salary) | Payroll, HR, compliance team salaries |

| Legal Liability | Assumed by EOR | Held by your company |

| Compliance Risk | Managed by EOR | In-house responsibility |

| Scalability | Easy to scale up/down | Slow, limited flexibility |

| Payroll Setup | Centralized via EOR | Managed separately in-country |

| Suitable For | Fast, flexible hiring | Long-term, large teams |

Risk Mitigation And Legal Compliance

Working with an Employer of Record (EOR) significantly reduces legal and financial exposure by ensuring strict adherence to local employment and tax regulations.

These providers stay current with changing labor laws, manage payroll and statutory contributions accurately, and carry liability for compliance, protecting your business from fines, disputes, and reputational risk.

Full Compliance With Local Labor Laws

Every country operates under unique labor rules, from leave entitlements and overtime pay to termination protocols and benefits mandates.

Employer of Record (EOR) providers take on the responsibility of fully aligning employment practices with local regulations, reducing legal exposure, and avoiding potential fines. They manage payroll, benefits, and statutory filings while staying current with revisions to labor codes.

This adherence helps safeguard companies from reputational damage and costly disputes.

Assumption Of Legal Liability

When an EOR serves as the formal employer, it assumes key administrative and legal liability, handling tasks like tax remittance, pension contributions, and contract compliance.

This ensures your business isn’t directly exposed to penalties from misclassification, payroll errors, or contract violations in unfamiliar or high-risk jurisdictions.

From real‑world experience:

“They handle compliance, payroll, and taxes, but you’ll still need to manage the relationship. We’ve used Rippling for this before, and it worked well, but there were some quirks with local tax filings.”, Reddit user.

“Payroll was done entirely by the EOR… technically, these were not our employees anymore, which made some HR‑esque conversations very difficult,” Reddit user.

Local Expertise And Disaster Preparedness

EORs maintain in-country HR and legal experts who continuously monitor regulatory changes, such as updates to minimum wage laws, employee classification criteria, immigration requirements, and mandatory benefits.

They conduct audits and adjust practices as needed to remain compliant across shifting landscapes.

In emerging and dynamic markets, such agility is critical. When laws evolve (for instance, through outsourcing reforms or payroll taxation changes), the EOR updates contracts and processes to reduce operational risk and ensure seamless business continuity.

Strategic Access To Global Talent In Key Markets

With an Employer of Record, your talent search stops being constrained by geography. Instead of limiting hiring to where you already operate, you can tap into high‑skill professionals across markets like India, Brazil, South Africa, and Southeast Asia.

This enables you to build teams with broader expertise and cost efficiency, without establishing legal entities abroad.

Broadened Talent Pool Beyond Borders

Emerging markets like India, Brazil, South Africa, Kenya, and Southeast Asia offer a wealth of skilled professionals in engineering, tech, design, and customer support.

By partnering with an Employer of Record (EOR), companies gain direct access to this talent without setting up a local branch. The EOR handles hiring, compliance, and payroll so you can build high-performing, cost-effective teams across borders seamlessly.

Why it matters: Diverse skills at a lower cost.

Competitive And Locally Compliant Benefit Packages

EORs craft benefits packages aligned with local norms, covering essentials like health insurance, pensions, paid leave, and bonuses. These offerings match employee expectations in each region and adhere to legal standards.

With local HR expertise, the EOR ensures contracts are compliant, clear, and delivered in local languages when needed.

Why it matters: Ensures talent attraction and retention.

Simplified HR Operations & Employee Experience

It’s worth understanding how an Employer of Record (EOR) can completely transform HR and employee engagement.

By taking charge of administrative tasks, from onboarding to payroll and offboarding, an EOR frees up employers and delivers a consistently seamless experience that builds trust and loyalty.

Streamlined Onboarding And Offboarding

An Employer of Record takes care of every administrative step, from drafting legally compliant contracts and collecting employee documentation to coordinating payroll setup.

During onboarding, new hires are guided through a welcoming, structured process that ensures clarity and consistency across regions.

Similarly, when an employee exits, the EOR manages exit interviews, final-pay calculations, statutory notices, and asset retrieval, ensuring a smooth, respectful separation.

Why it matters: Creates professional and consistent employee transitions.

Consistent, Locally Compliant Payroll

EORs administer payroll in exact accordance with local requirements, handling currency conversions, tax withholding, social security, and statutory benefits on schedule.

They use centralized HR systems and local expertise to ensure accurate and timely payments, eliminating payroll errors and delays that can damage trust.

Why it matters: Builds reliability and trust through payment accuracy.

Boosted Engagement And Retention

Partnering with an EOR often leads to higher employee satisfaction, as staff receive compliant benefits, reliable payroll, and streamlined HR services, particularly across borders.

Studies have shown that using EORs can raise employee satisfaction by around 20%, significantly improving retention rates compared to informal contractor setups.

Why it matters: Enhances loyalty and long‑term workforce stability.

Enhanced Focus On Core Strategy

When partnering with an Employer of Record, companies effectively offload time-consuming tasks like payroll, benefits administration, HR compliance, and legal documentation.

The EOR handles these responsibilities efficiently, drawing on established infrastructure and local expertise. This means your internal teams, especially senior leadership, product development, sales, and marketing, are freed from administrative overload.

Instead of wrestling with employment regulations across multiple countries, they can devote attention to building strategic roadmaps, innovating products, and delivering better customer experiences.

Studies have shown that organizations can see up to a 25% increase in operational efficiency when HR responsibilities are outsourced to an EOR.

Ultimately, the EOR model transforms employment logistics from a burden into a service, giving companies the breathing room to grow, pivot, and compete more effectively in dynamic markets.

Why It Matters

- Free time for strategy and innovation

- Removes HR distractions from leadership focus

- Enhances productivity by reducing admin burden

- Keeps operations aligned with growth goals

- Maximizes the impact of internal talent efforts

Challenges And Considerations, Ethical Use In Emerging Markets

It’s important to recognize that EORs can introduce risks around compliance, costs, and employee welfare that demand careful oversight. Companies must balance expansion speed with ethical and legal responsibilities.

- Higher per-employee cost over time: EOR services often include hidden fees for mandatory benefits, document processing, and severance, raising long-term costs beyond salary budgets.

- Permanent establishment (PE) risk: Relying on EOR arrangements without proper licensing can accidentally create a permanent establishment, exposing firms to local tax liability.

- Benefits variance and limited perks: Some EORs provide only statutory-minimum benefits, lacking premium healthcare or retirement perks, which may hinder talent attraction.

- Offboarding limitations and rigid terminations: Local termination rules govern offboarding through EORs, restricting flexibility and potentially exposing firms to costly notice or severance requirements.

EOR In Practice, Case Scenarios In Strategic Regions

These real-world scenarios illustrate how companies leverage EOR services to expand internationally in key emerging markets.

By partnering with local EOR providers, they bypass entity setup and legal hurdles while ensuring compliant and efficient hiring across regions like South Asia, Latin America, Eastern Europe, and Africa.

Entry To India And South Asia

A U.S. component-manufacturing firm engaged a local EOR to shift operations from China to India without registering a legal entity. The EOR managed employment contracts, payroll, compliance with Indian labor codes (PF, ESIC, gratuity), and supplier relationships, enabling early market entry and risk mitigation before full entity setup.

Latin America Expansion

A Chinese automotive manufacturer partnered with an EOR for expansion into five Latin American countries. The provider handled local regulations, payroll, VAT compliance, and labor law adherence, resulting in $150,000 in savings from entity setup costs and zero legal issues during deployment. They onboarded local and international staff rapidly.

Eastern Europe & Africa

Tech companies expanding into Eastern Europe (e.g., Romania, Poland) utilized an EOR to hire development teams without entity registration.

Alcor’s EOR service enabled building an R&D center within three months, saving setup costs and ensuring 100% compliance, while accessing top-tier engineering talent.

In Africa, EOR adoption allowed compliant team building in unpredictable regulatory environments like Nigeria and Kenya.

Selecting The Right EOR Partner

Choosing an Employer of Record is more than a mere procurement decision; it directly influences your global employees’ experience and legal standing.

Ensure your EOR provider has comprehensive geographic coverage, proven compliance expertise, and earned trust through strong client feedback and testimonials.

- Geographic coverage: Ensure the EOR operates in all current and target countries, using owned entities for seamless onboarding.

- Legal compliance expertise: Verify that the provider demonstrates robust local knowledge of employment law, taxes, benefits, and regulatory updates.

- Reputation and references: Review client testimonials, case studies, and independent reviews to assess service quality and reliability.

- Service breadth: Choose an EOR offering payroll, benefits, onboarding/offboarding, contractor management, and consulting within one platform.

- Pricing transparency: Look for clear per‑employee or payroll‑based fees, with no hidden charges for setup or offboarding.

- Technology integration: Ensure the platform integrates smoothly with your HR, finance, and project management tools.

- Customer support responsiveness: Confirm prompt support via defined SLAs, account manager access, and multilingual availability.

- Scalability & flexibility: Partner with an EOR that can adjust quickly to changes in headcount or geographic expansion.

- Employee experience focus: Assess how the EOR supports employees with clear communication, timely payroll, and benefits handling.

- Cultural alignment: Choose a partner whose values and work culture align with yours for harmonious long-term collaboration.

- Data security standards: Confirm compliance with GDPR or SOC2, and strong data protection protocols for employee and company information.

- Longevity & stability: Prefer experienced providers with a track record of continuous service and adaptation over many years.

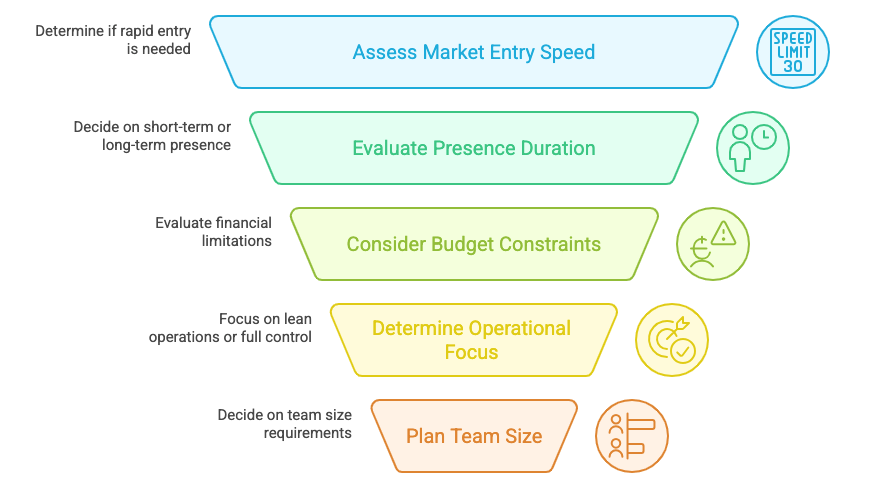

EOR vs Entity Setup Decision Funnel

Summary: The EOR Edge For Emerging Market Expansion

Leveraging an Employer of Record in emerging markets delivers rapid, hassle‑free access to local talent while avoiding the delays and investment of entity setup.

By transferring legal obligations to the EOR, businesses mitigate compliance risk and administrative burdens, enabling them to scale efficiently and focus on market growth.

| Benefit Area | Advantage Summary |

| Speed to Market | Hire employees fast without entity setup in days. |

| Reduced Costs | No entity costs; predictable per-employee fee model. |

| Reduced Risk | Local compliance and legal liability are managed by the provider. |

| Talent Access | Tap into skilled professionals globally without a presence. |

| Employee Experience | Local benefits, onboarding, and payroll consistency. |

| Internal Focus | Strategic objectives are unaffected by administrative burdens. |

Conclusion

For businesses seeking to enter emerging markets with minimal friction, minimal upfront investment, and maximal legal safety, the Employer of Record model offers a compelling advantage.

From accelerated hiring and global talent access to robust compliance and streamlined HR operations, EOR services empower firms to focus on growth, not bureaucratic overhead.

That said, successful EOR deployment requires careful due diligence. Understand provider licensing, fee structures, employee benefits, and termination policies.

Work with a partner who offers audit-ready compliance, tech-forward platforms, and proven multi-country capabilities.

If you’re exploring expansion into regions such as India, Latin America, or Southeast Asia, and you need help evaluating EOR providers or calculating ROI, I’d be happy to assist further.